Welcome to Kasheesh: Your Guide to Smart Spending

What is Kasheesh?

Kasheesh is a cutting-edge financial technology platform that revolutionizes the way you manage your spending. With Kasheesh, you can create a virtual Mastercard Debit Card by combining up to 5 of your existing credit or debit cards, allowing you to split payments across your cards both online and at physical stores. This innovative approach provides you with unprecedented flexibility and control over your finances.

Key Features:

Kasheesh Card: Our primary virtual card supports Tap-to-Pay functionality, making it perfect for everyday use. With a Kasheesh Card, we only charge your cards when you make a purchase or make a payment.

Single-Use Card: For added security on one-time purchases, we offer single-use virtual cards. We charge your cards when you create a single-use card, so think of it like a pre-loaded card.

Mastercard Powered: All our virtual cards are backed by Mastercard's global network and security.

Note: Kasheesh is not a Buy Now, Pay Later service. Instead, it leverages your existing credit to help you make payments more efficiently.

Getting Started with Kasheesh

Verify Your Identity

Before you can start using Kasheesh, you'll need to verify your identity. We use Plaid, a secure financial services platform, to ensure the safety of your information. For more information take a look at our Help Hub article: Understanding Kasheesh Verification Process

Add Your Cards

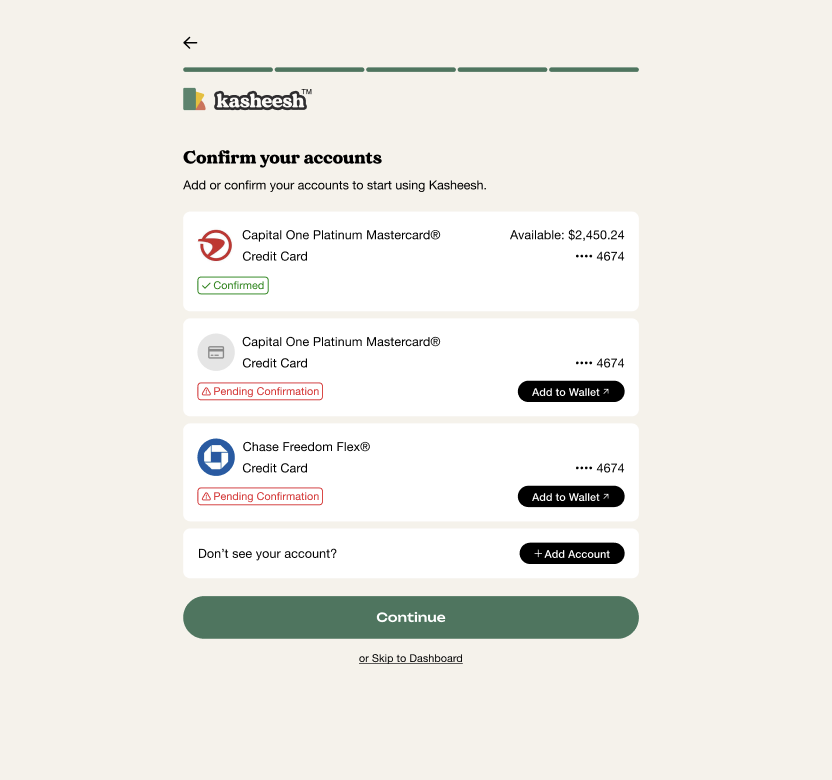

During Onboarding: Welcome to Kasheesh! Please select Verify with Plaid, then click +Add Account to securely connect your bank accounts.

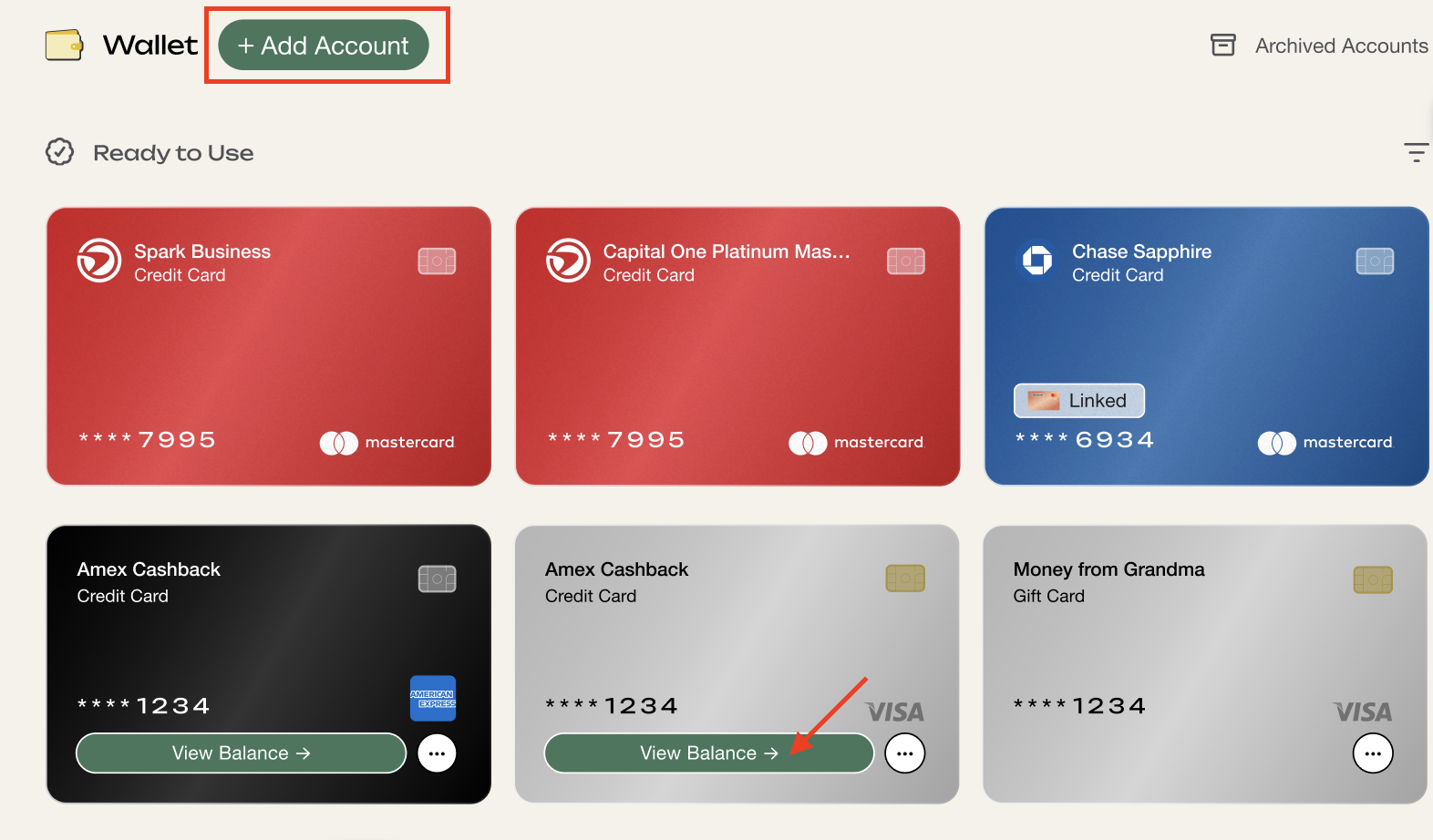

After Onboarding:

Select the Wallet tab from your account's top navigation menu, then choose + Add Account to add any additional cards to your Kasheesh account. If you did not confirm your card during onboarding, please note that selecting View Balance will also prompt you to complete the linking process through Plaid.Benefits of linking with Plaid:

Smart split for single-use purchases

View all your account balances from a single screen

Higher spending limits (More info on Spending Limits)

Create Your Kasheesh Card

Kasheesh Card

We recommend creating a Kasheesh card for most users. The Kasheesh Card is the cornerstone of the Kasheesh experience, offering unparalleled flexibility by allowing you to combine multiple funding sources into a single, powerful virtual card.

How to create a Kasheesh Card:

Navigate to "Kasheesh Cards" from the top of your navigation menu

Select "Create Card" from the upper right corner

Choose "Kasheesh Card",

Set the desired percentage for each card you want to use. Must equal 100%.

Review and confirm your Kasheesh Card details

Kasheesh Card Benefits:

Consistent card number, but you can swap out underlying cards anytime

Save to your favorite stores and use for recurring purchases

Add to Apple/Google Wallet for on-the-go convenience

Your linked cards are charged only when you use your Kasheesh card.

Kasheesh Cards are ideal for:

Everyday purchases and regular spending

Recurring bills or subscriptions you want to manage flexibly

Situations where you want to split purchases across multiple funding sources

Users who want a single card for various types of transactions

Adding to digital wallets for convenient mobile payments

Note: You can have only one Kasheesh Card at a time, but you can adjust its underlying cards and split percentages at any time by selecting the gear icon to manage cards from your home page.

Single-Use Card

For added security and convenience, we also offer one-time use cards. Here are some important things to know about single-use cards:

How to create a Single-Use Card:

Navigate to "Kasheesh Cards" from the top of your navigation menu

Select "Create Card" from the upper right corner

Choose "Single-Use Card",

Set the desired amount to each card.

Review and confirm your Single-Use Card details

Single-Use Card Benefits

One-Time Use: Can only be used once, providing enhanced security.

Pre-loaded Functionality: Funds are withdrawn immediately upon card creation, not at purchase.

Exact Amount Matching: Transactions are declined if they don't match the exact card amount.*

Billing: Charges appear as "KASHEESH" or "KASHEESH, INC." on your statement.

Unused Cards: Become inactive if not used, with charges reversed within 2-3 days.

Single-use cards are ideal for:

Subscriptions you don't want to renew automatically

One-time purchases or specific splits

Users who are particularly security-minded

*Some retailers, such as Amazon, may charge your card separately for each item as it ships, rather than charging the full amount at once, especially if your order contains multiple items that ship at different times. This is an instance where a Single-Use Card would decline due to a mismatch in amount, and therefore we recommend using the Kasheesh Card for Amazon and similar stores.

Fees and Promotions

Both the Kasheesh Card and Single-Use cards incur a 2% transaction fee. However, keep an eye out for promotions that might waive or reduce these fees through our newsletter and through our blogs: Finance Academy

Also, be on the lookout for our Rewards feature we are looking to launch in the near future!

Start Spending Smarter with Kasheesh

Now that you're all set up, you can start enjoying the benefits of Kasheesh. Remember, our platform is designed to give you more control over your spending by allowing you to combine your existing credit and debit cards into versatile virtual cards.

For any questions or support, don't hesitate to reach out to our customer service team. Happy spending!